In Markets

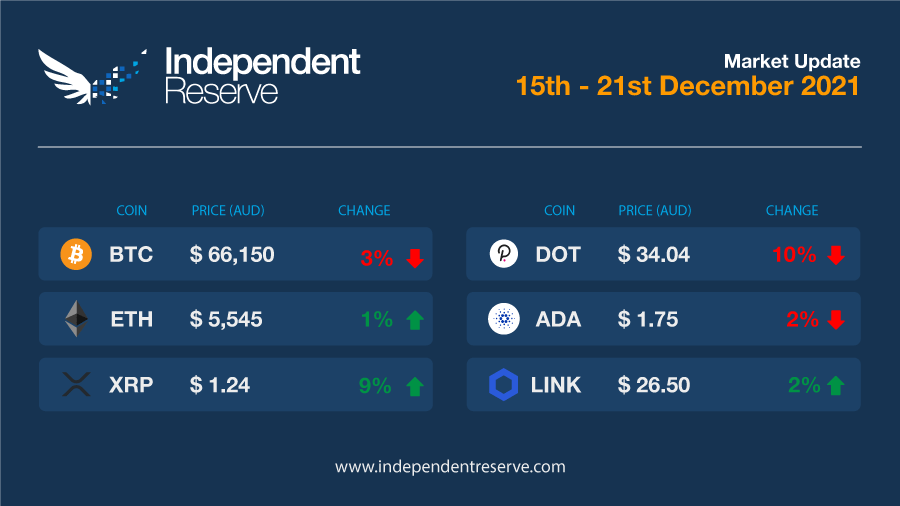

The Bitcoin price is around one third down from its all-time high price a little over a month ago. But while sentiment is bearish, on chain metrics remain strong and miners are holding on to their coins, with outflows halving in the last month and unspent supply about to hit a new ATH. Bitcoin spent most of the week trading between AU$64K and AU$69K (US$46K to $50K) and finished the week roughly where it began, around AU$66,000. Ethereum gained 1% and is trading around AU$5,550, Cardano was flat, XRP was up 9% and Dogecoin gained 3%. The Crypto Fear and Greed Index spent the week in the ‘Fear’ zone, but fell today down to 25 or Extreme Fear.

From the IR OTC Desk

As expected by the market, last week’s US FOMC meeting confirmed that the speed of asset purchase reductions would be increased from $US15B per month, to $US30B per month ($US20B Treasuries, $US10B MBS). If this pace of reduction were to remain constant, the quantitative easing program is expected to conclude in March 2022. While Chair Powell has always suggested that monetary policy will remain data dependent, including the speed and flexibility of asset purchase reductions, the Fed seems more conscious of the immediate effects of higher rates of price inflation, rather than their longer-term forecast. In a sign of a more ‘hawkish’ economic view, the median Committee forecast is for three interest rate hikes in 2022 and an additional three interest rate hikes in 2023.

In the December Reserve Bank of Australia (RBA) meeting, the Board highlighted the need for the labour market to become ‘tight enough to generate wages growth, that is materially higher than it is currently’ before assessing the level of the cash rate. Last week’s domestic employment data, saw the Unemployment Rate (Nov.) move down to 4.6% (from 5.2%) with an Employment Change (Nov.) of +366.1k jobs! Attention will now move to January’s CPI release, as well as the RBA’s February Board meeting which is expected to reassess the pace of domestic asset purchases.

On the OTC desk, while volumes have increased over the week, the broader crypto market has continued to be ‘choppy’ and in general, has trended sideways. In previous years, as we have moved further into the holiday season, the reduction of liquidity has created sharp changes in price action, on low volumes. This week, name specific layer 1’s outperformed the broader market, positively retracing early monthly moves. Of note, Luna has created a new all-time high while AVAX continues to be of growing interest to the market.

For any trading needs, please don’t hesitate to get in touch.

In Headlines

There ain’t no Santa Claus

Bullish traders are coming to terms with the fact that there has been no Santa Claus rally this year and the chances of hitting those US$100K (AU$140K) end of year predictions are slim to non-existent. Three Arrows Capital CEO Zhu Su however is optimistic about the current situation. He says that short term investors have been flushed out, BTC and ETH supply on exchanges is hitting new lows and the “largest asset allocators in world [are] aligned with crypto thesis”. “It’s just hard to be too bearish“, he says.

Package fails

In the US, the opposition of a single senator spelt doom for President Joe Biden’s US$1.75 trillion (AU$2.46T) spending package. While financial stimulus has proven extremely beneficial for crypto prices in the past, the package had a couple of nasty riders for crypto investors. It would have imposed capital gains taxes for when investors take offsetting short and long positions on crypto assets and barred investors claiming a deduction for selling at a loss if they bought the same asset within 30 days.

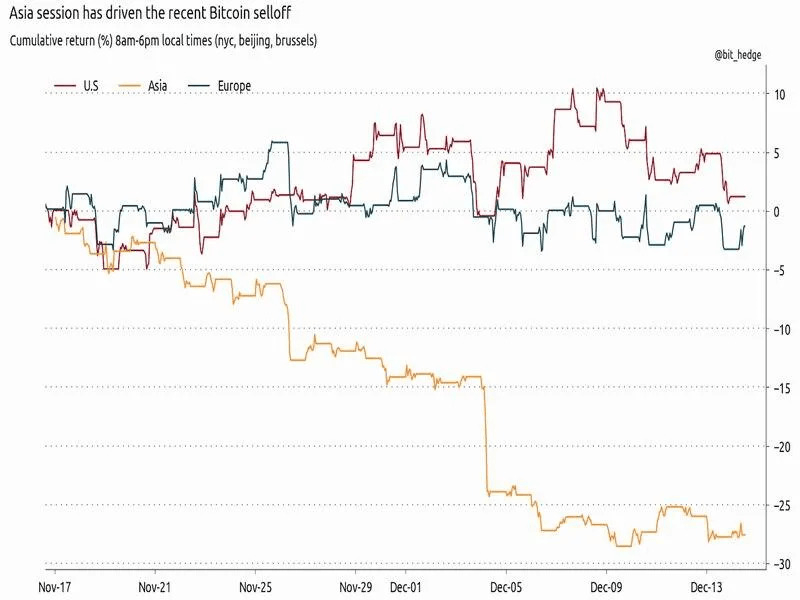

Asian time zone is bearish

Data from options trader Fredrick Collins shows that Bitcoin and Ether faced selling pressure consistently this year during Asian trading hours, and went up on US times. The majority of the year-to-date gains for Bitcoin (60%) and Ethereum (40%) were made during 8am and 6pm New York time.

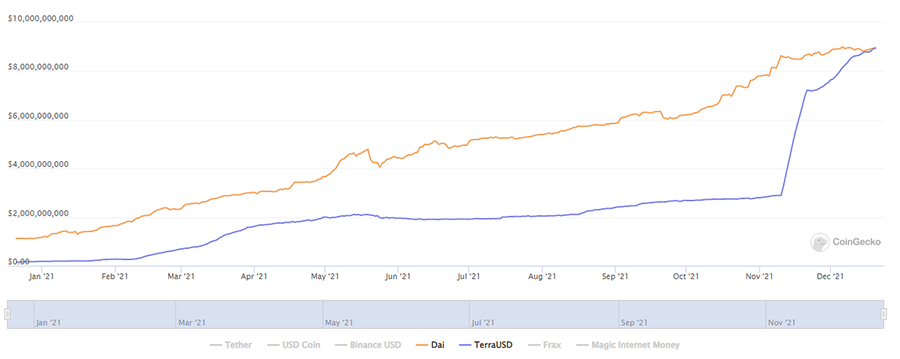

Stablecoin supply surges in 2021

The USD stablecoin supply, including Tether and USD Coin (USDT and USDC) surged by 388% in 2021 according to The Block. It began the year at US$29B and has grown to more than $140B. Interestingly Terra’s USD stablecoin UST today overtook DAI as the fourth largest stablecoin and its market cap is now above $9 billion.

Market capitalisation of Maker’s DAI and Terra’s UST. Source: CoinGecko

Bans, bans, bans

India’s long awaited crypto bill is unlikely to be introduced in the current session of Parliament ending on December 23, according to the Times of India. Russia has also been weighing up a ban, with the Bank of Russia banning mutual funds from investing in crypto and central bank governors making highly critical remarks suggesting a ban was on the table. However the chair of the Russian Parliament’s Financial Markets Committee, Anatoly Aksakov, said while a ban was possible, crypto may instead be regulated and have mining taxed. And just when you thought there was nothing left for Chinese authorities to crack down on, CNBC reports that 20% of the Bitcoin mining hashrate may still be operating underground in the country.

CFTC chair confirmed

Rostin Behnam, the acting chair of the Commodity Futures Trading Commission since January has been officially confirmed as the permanent chair. Behnam has been pushing for the CFTC to become the “primary cop on the beat” regulating cryptocurrencies. During his time the CFTC has slapped Tether and Bitfinex with a $42.5M (AU$60M) fine and reached a settlement with BitMEX to pay a $100M (AU$140M) penalty. President Joe Biden has also just announced two other picks for CFTC commissioners.

Top picks by traders

The Real Vision Bot is reportedly outperforming the top 20 coins by around 20%, simply by reallocating based on surveys of traders. The latest survey shows 39% of traders are heavy on ETH, 33% on Solana, 24% on Algorand, and 23% each on Bitcoin and Avalanche.

Big guys have all the BTC

A study by the National Bureau of Economic Research in the US found that the top 10,000 Bitcoin accounts hold 5 million BTC between them. The Wall Street Journal noted: “With an estimated 114 million people globally holding the cryptocurrency, that means that approximately 0.01% of bitcoin holders control 27% of the 19 million Bitcoin in circulation.” However as Quantum Economics founder Mati Greenspan points out, 5% of the supply belongs to Satoshi, and others have noted that around 4 million BTC is believed lost.

Bits and pieces

The Grayscale Bitcoin Trust is now trading at a 22.95% discount, which is the largest ever. TRON founder Justin Sun has announced the Tron Foundation is disbanding and control of the protocol will be handed over to a DAO. Sun is also taking a job as Grenada’s ambassador to the World Trade Organization. New data from Glassnode showing ETH withdrawals in the past week fell to a one year low of 1176. The Securities and Exchange Commission in the US has postponed its decisions on the Bitcoin spot ETF applications by Grayscale and NYSE Arca to the first week of February 2022. The UK’s Advertising Standards Authority has ruled against crypto trading ads from Coinbase, Kraken, eToro, Exmo, Coinburp and Luno stating the ads did not make it clear that past price increases were no guarantee of future ones. CEO Michael Saylor said on MicroStrategy’s shareholders call that the company might lend out its Bitcoin holdings for yield. TIME’s Man of the Year Elon Musk announced Tesla would accept Dogecoin as payment for merchandise and claimed that it’s better suited to transactions than BTC. Yorke Rhodes, the Director of Digital Transformation at Microsoft, predicts that Ethereum will become the defacto decentralised App Store sometime around 2023 after the merge and sharding has occurred.

Thought for the year

It never pays to write off Bitcoin. According to 99Bitcoins, BTC was declared dead 42 times in 2021, three times more often than in 2020, and it just keeps on keeping on.

Until next week, happy trading!